Ask Real Estate - Orange County Housing Market Snapshot

Orange County Housing Market Snapshot

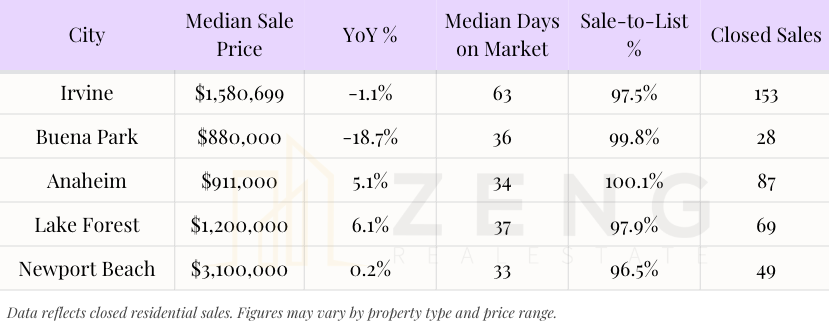

Key City Data | Updated Monthly

Email: myhome@zengrealestate.com

Data reflects closed sales through December 2025. This page is updated regularly.

This page provides a regularly updated snapshot of the Orange County housing market, with a focus on key cities buyers and sellers frequently ask about.

The data shown here reflects closed sales, not asking prices or headlines. It is intended to offer context—how pricing, timing, and buyer behavior are evolving across different parts of Orange County—rather than predictions about where the market “should” go next.

Because real estate conditions vary meaningfully by city and price range, this page highlights a small set of representative markets for comparison, including Irvine and select North and Central Orange County cities. The tables are updated periodically as new data becomes available.

Latest update: December 2025

How to Read This Market Snapshot

When reviewing the tables below, a few points are worth keeping in mind:

Median Sale Price reflects the midpoint of closed transactions, not list prices. It can shift based on the mix of homes sold in a given month.

Month-over-Month Change shows short-term momentum and can be volatile, especially during seasonal transitions.

Year-over-Year Change provides broader context but should be read alongside volume and days on market.

Days on Market often signals buyer behavior before prices adjust, particularly in shifting conditions.

Sale-to-List Price Ratio helps indicate negotiating dynamics, not just pricing strength.

No single metric tells the full story. Trends become clearer when these indicators are read together and interpreted in the context of local conditions.

Neutral City-by-City Interpretation Bullets

Irvine

Pricing remains relatively resilient compared to surrounding markets.

Longer days on market suggest buyers are more selective, particularly at higher price points.

Activity reflects a market driven by planning consistency rather than short-term momentum.

Buena Park

Price movement appears more sensitive to transaction mix than headline trends.

Days on market highlight a value-oriented buyer pool focused on practicality and access.

Sales volume suggests steady demand rather than speculative activity.

Anaheim

Market performance varies meaningfully by neighborhood and housing type.

Volume levels indicate ongoing liquidity, though pricing behavior is not uniform.

Buyer activity reflects a broad range of use cases, from owner-occupants to long-term investors.

Lake Forest

Pricing trends reflect mid-OC dynamics, balancing affordability and planning stability.

Days on market suggest measured buyer engagement rather than urgency.

Sales activity remains consistent with long-term residential demand.

Newport Beach

Pricing and sales patterns reflect discretionary, high-price-point decision-making.

Longer marketing timelines are common and do not necessarily indicate weak demand.

Activity is more influenced by buyer timing and preferences than by monthly shifts.

📩 Stay Informed

Want the updated table when new data is published? Subscribe and I’ll send the latest snapshot.

No spam. Unsubscribe anytime.

Phone: (714) 902-3135

Email: myhome@zengrealestate.com