Ask Real Estate - Is the Irvine Real Estate Market Actually “Cooling Down”?

Is the Irvine Real Estate Market Actually “Cooling Down”?

Is the Irvine Real Estate Market Actually “Cooling Down”?

Email: myhome@zengrealestate.com

The $100,000 Ghost

Imagine it’s February 2027. You’re sitting at your kitchen table, looking at the Irvine housing stats. Interest rates finally hit 5.2%. You smile, ready to call your Realtor—only to realize that the home you wanted for $1.6M today is now selling for $1.75M with 15 competing offers.

You "saved" 1% on your interest rate, but you just paid $150,000 more for the house. This is the "Ghost of the Market"—the hidden cost of waiting that no one talks about until it's too late.

“Cooling down” is a phrase many buyers and sellers are hearing—but few agree on what it actually means in Irvine.

Some interpret it as falling prices.

Others feel it as hesitation: fewer rushed offers, longer decision timelines, and more buyers choosing to wait and watch.

This article looks at what the data actually shows—and how buyer behavior, especially the rise of the “wait-and-see” mindset, fits into the current Irvine market.

What Does “Cooling Down” Actually Mean in Real Estate?

In real estate, “cooling” is often used loosely, as if it describes a single condition. In practice, it can refer to very different things:

Prices changing (or not changing)

Homes taking longer to sell

Fewer competing offers

Buyers becoming more selective

Sellers adjusting expectations

These are not the same signal.

A market can slow in pace without meaningfully declining in value. Likewise, buyer hesitation does not automatically mean demand has disappeared.

Understanding whether Irvine is “cooling” requires separating price, velocity, and behavior—rather than relying on headlines or sentiment alone.

What the Irvine Data Shows Right Now (Before Interpreting It)

Looking at recent closed-sale data rather than asking prices, several patterns stand out:

Median sale prices have shown relative stability, with variation driven by which segments are transacting

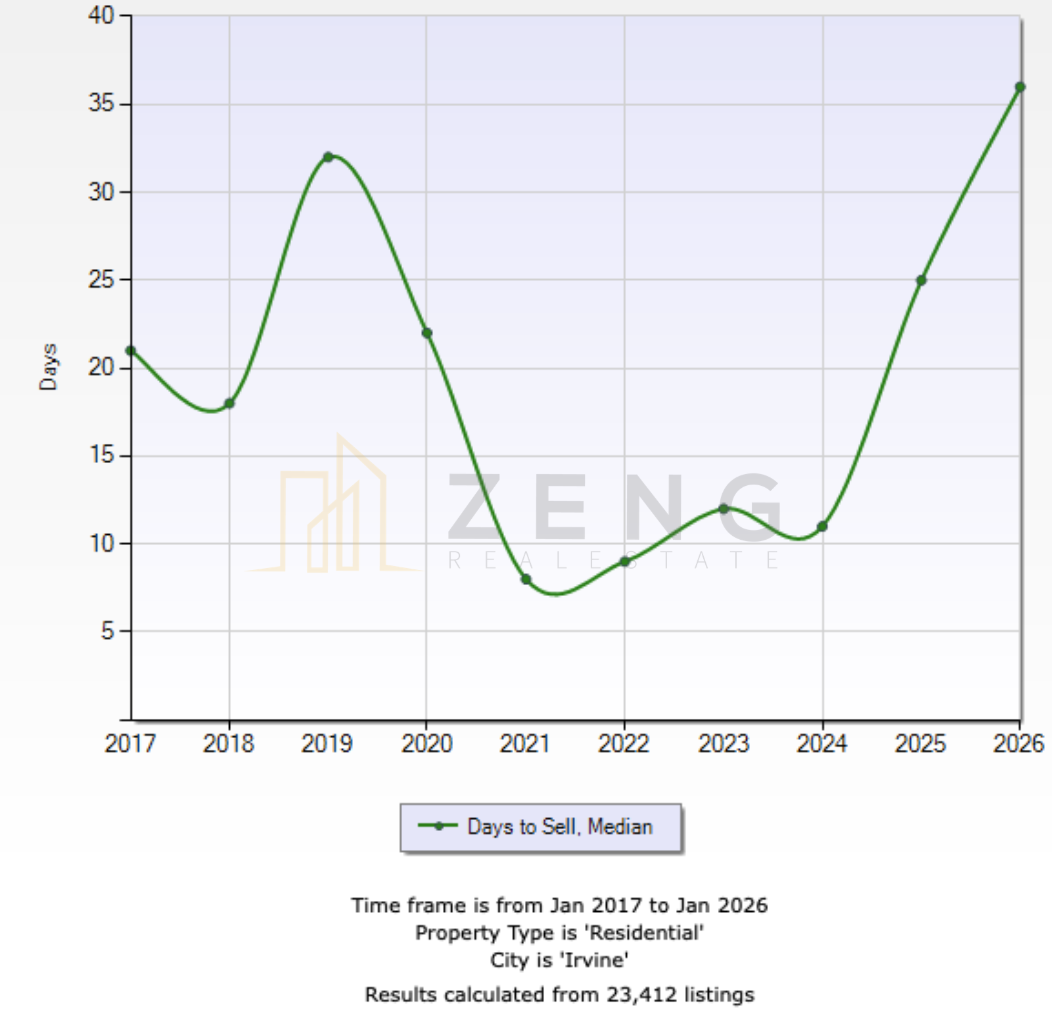

Days on market have lengthened compared to peak urgency periods

Sale-to-list price ratios suggest negotiation has become more common

Closed sales volume reflects ongoing activity, though with more deliberate pacing

On their own, these metrics do not point to a sudden downturn. But they do suggest a shift in how transactions are happening.

The data establishes context. The behavior explains the story.

The Rise of the “Wait-and-See” Buyer

One of the most noticeable changes in Irvine right now isn’t the absence of buyers—it’s their posture.

Many buyers are not exiting the market. They are watching, waiting, and trying to decide whether patience will be rewarded.

“Wait and see” typically reflects one or more of the following:

uncertainty about price direction

sensitivity to interest rates

desire for more inventory choice

concern about overpaying emotionally

This is not indecision for its own sake. It is a shift in how risk is evaluated.

In previous high-pressure cycles, buyers often felt urgency first and rationalized later. Today, many are doing the opposite.

The "Irvine Bubble" vs. National Headlines

One of the biggest hurdles for Irvine buyers right now is the "Noise." If you turn on the national news, you hear words like "Correction," "Slowdown," and "Price Drops."

But Irvine is a master-planned anomaly. We aren't the national average.

The Reality: While the national median is under $400k, Irvine's median is hovering near $1.6M.

The Demand: We are an international hub for tech, education (UCI), and safety. Demand here doesn't disappear; it just compresses.

The Spring 2026 Shift: We are entering what economists call the "Great Housing Reset." For the first time in years, inventory in Orange County has grown by nearly 30% year-over-year. This doesn't mean a crash; it means choice.

How “Waiting” Shows Up in Market Behavior

This change in mindset shows up clearly in transaction patterns:

Homes often receive interest, but fewer immediate offers

Buyers take more time to compare alternatives

Price sensitivity is higher within certain bands, while others remain resilient

Some buyers walk away—but continue tracking the same neighborhoods closely

In other words, waiting is not passive. It is active monitoring with higher standards.

This helps explain why the market can feel slower without being inactive.

What Waiting Can Change—and What It Can’t

One of the most common unspoken questions among wait-and-see buyers is:

“If I wait, will the outcome clearly improve?”

The honest answer is nuanced.

What waiting can change:

It may improve negotiation leverage in specific segments

It can allow buyers to evaluate more options over time

It often increases buyer confidence and clarity

What waiting does not guarantee:

Broad price declines across all of Irvine

Uniform seller behavior

A clear signal of “perfect timing”

In Irvine, waiting tends to change how transactions unfold more than whether they happen.

Cooling vs Normalization: Why the Distinction Matters in Irvine

Irvine has historically behaved differently from markets driven by speculation or rapid turnover.

Much of what is being described as “cooling” looks more like normalization:

more time to decide

fewer emotional bids

clearer separation between well-priced and aspirational listings

In a market like Irvine, this phase often reflects discipline, not distress.

Understanding that distinction matters for both buyers and sellers.

What This Means for Buyers in “Wait-and-See” Mode

Waiting can be a rational strategy—but it works best when paired with intention.

Rather than watching headlines, effective waiting usually involves:

tracking specific neighborhoods, not the entire city

paying attention to days on market rather than list prices

noticing which price ranges show flexibility and which do not

clarifying personal priorities before acting

This approach keeps buyers informed without pressuring them to act prematurely.

What This Means for Sellers Right Now

For sellers, the presence of wait-and-see buyers changes expectations—not opportunity.

Buyers are still active, but more selective

Pricing accuracy matters more than momentum

Over-testing the market carries greater risk

Preparation and positioning matter more than urgency

Homes that align with buyer expectations still move. Others may sit—not because demand vanished, but because buyers now feel comfortable waiting.

So, Is the Irvine Market Actually Cooling Down?

The most accurate answer is: parts of it are slowing in pace, but not disengaging.

Buyer behavior has shifted toward caution and deliberation. Decision velocity has changed. But interest remains—especially for homes and neighborhoods that align clearly with buyer priorities.

What’s changing most in Irvine right now isn’t demand.

It’s how decisions are made.

A Market Defined by Intentionality

Markets rarely stop all at once. What pauses first is urgency.

Irvine’s current phase rewards clarity—from both buyers and sellers. Understanding behavior matters as much as understanding numbers.

In this environment, asking how people are choosing is often more useful than asking where prices will go next.

Phone: (714) 902-3135

Email: myhome@zengrealestate.com