Ask Real Estate - If You’re Waiting to Buy in Irvine, What Should You Actually Be Watching?

If You’re Waiting to Buy in Irvine, What Should You Actually Be Watching?

Email: myhome@zengrealestate.com

Many buyers today say the same thing:

“We’re just going to wait and see.”

But very few can clearly articulate what, exactly, they’re waiting for.

Lower prices?

Lower interest rates?

More inventory?

A clearer signal from the market?

In Irvine, “wait-and-see” has become one of the most common buyer postures. Yet waiting, by itself, is not a strategy. It’s a stance.

The difference between passive waiting and intelligent waiting is understanding what actually matters—and separating signal from noise.

If you’re in wait-and-see mode, here’s what you should truly be watching.

Waiting Is Not Inactivity — It’s Risk Reassessment

Let’s start with something important:

Waiting does not mean you’re unsure. It often means you’re recalibrating risk.

Compared to the urgency-driven cycles of recent years, today’s buyers are:

More analytical

More comparison-oriented

More price-sensitive

Less emotionally reactive

That shift is not weakness. It’s discipline. But discipline only works if it’s grounded in measurable indicators—not headlines or anecdotal comments

The Three Indicators That Actually Matter

When buyers say they’re waiting, they often monitor mortgage rates or news headlines. Those factors matter, but they don’t fully explain Irvine’s micro-market behavior.

If you want clarity, focus on these three:

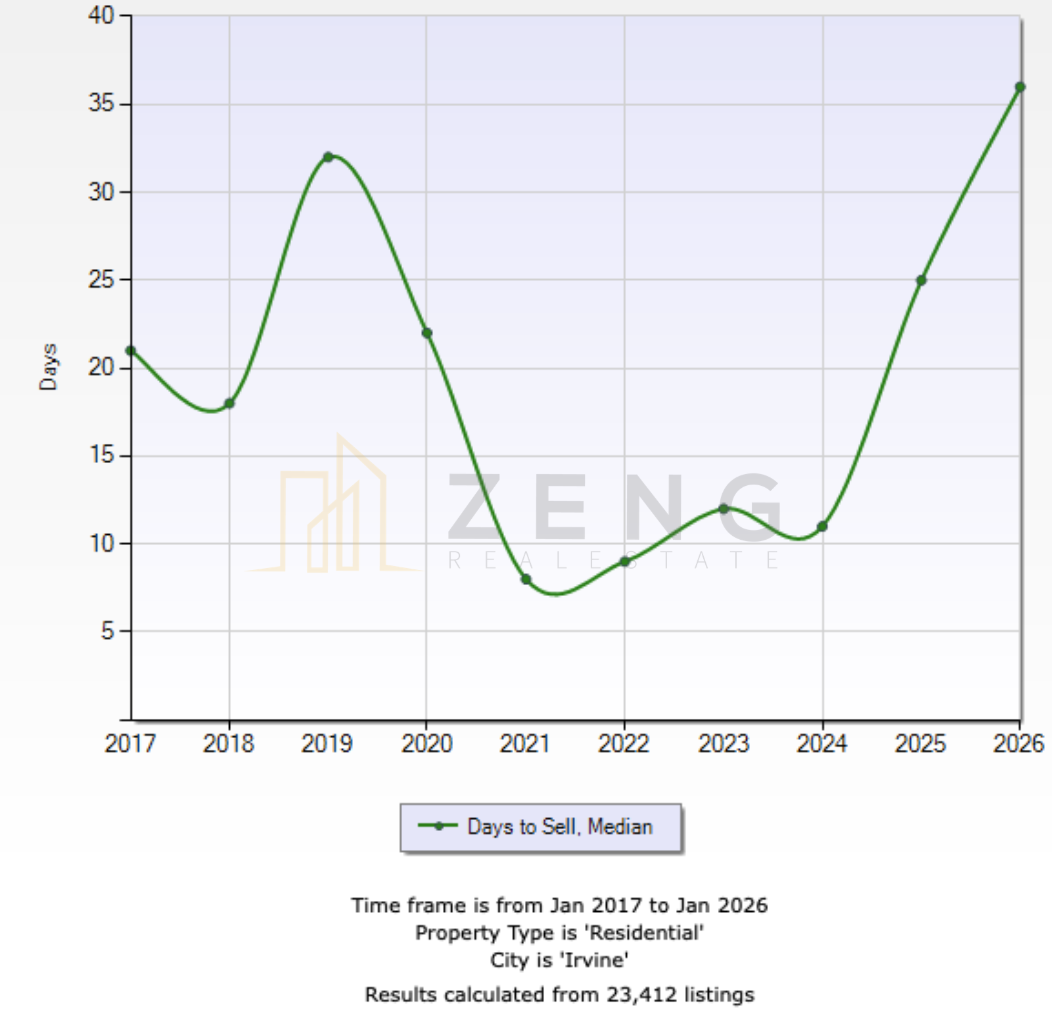

1️⃣ Days on Market — By Neighborhood, Not Citywide

Citywide averages can mislead.

Irvine is not a single market. Portola Springs behaves differently from Northwood. Turtle Rock behaves differently from newer master-planned communities.

Days on Market (DOM) tells you:

How quickly buyers are making decisions

Whether urgency is increasing or decreasing

How much room exists for negotiation

When DOM lengthens meaningfully within a specific neighborhood, it often signals that buyers are taking more time—not necessarily that prices are collapsing.

This distinction matters. A slower decision pace creates leverage, but it does not automatically produce discounts.

2️⃣ Sale-to-List Price Ratio — The Negotiation Temperature

Many buyers obsess over list price reductions. But the real story often lies in the sale-to-list ratio.

When homes consistently sell:

Above list → competitive heat

At list → balanced pricing

Below list → negotiation normalization

If you notice the ratio gradually declining within your target price band, that’s a more reliable sign of softening than scattered price drops.

It shows sellers are adjusting—not panicking. In Irvine, broad price resets are rare. What changes first is pricing discipline.

3️⃣ Inventory Behavior Within Your Price Segment

Irvine’s luxury segment does not move the same way as its entry-level condos. Newer construction does not behave like established neighborhoods.

When monitoring inventory, ask:

Are similar homes accumulating?

Are listings being withdrawn and relisted?

Are sellers adjusting within 2–3 weeks or holding firm?

Segment-specific supply tells you more than total active listings. A rise in inventory combined with longer DOM within your exact price range is meaningful. A general increase citywide may not be.

Noise vs. Signal: What Most Buyers Misinterpret

In a cautious market, isolated events are often mistaken for trends.

Here are common examples of noise:

One dramatic price reduction

One home sitting unusually long

One over-optimistic seller

These do not define direction.

Real signals require:

Repetition

Consistency across comparable homes

Data over multiple weeks or months

Waiting intelligently means resisting emotional interpretation of isolated listings.

When Waiting Helps — And When It Doesn’t

Waiting can create advantages. But those advantages are conditional.

When Waiting Can Be Beneficial

When inventory is rising within your target neighborhood

When sale-to-list ratios show negotiation is expanding

When your personal financial position strengthens over time

In these cases, patience can improve leverage and comfort.

When Waiting Becomes Less Productive

When your target segment remains supply-constrained

When prices stay stable but interest rates fluctuate unpredictably

When you repeatedly “almost buy” but reset expectations each time

In Irvine, constrained inventory in high-demand neighborhoods can neutralize the benefits of waiting.

You may gain time, but not necessarily pricing advantage.

The Hidden Cost of Passive Waiting

Most buyers focus on potential savings. Fewer consider opportunity cost.

Opportunity cost in real estate includes:

Missing out on ideal floor plans

Delayed lifestyle transitions

Increased competition if market sentiment shifts

Emotional fatigue from extended monitoring

Waiting without structure often leads to exhaustion—not clarity.

A Practical Framework for Intelligent Waiting

If you choose to wait, do it deliberately.

Here’s a structured approach:

Step 1: Define Your Non-Negotiables

Not “nice to have.”

Not “if possible.”

What are the three features that truly matter?

School boundary?

Square footage threshold?

Specific neighborhood?

Clarity reduces hesitation later.

Step 2: Track 10 Comparable Homes

Instead of scrolling casually, track specific comparables.

Record:

List price

Final sale price

Days on market

Price adjustments

Patterns become visible quickly when tracked intentionally.

Step 3: Watch Behavior, Not Headlines

Ignore:

National commentary

Broad market panic

Social media sentiment

Focus on:

Your target streets

Your exact price band

Actual closing prices

Local data always outweighs macro headlines.

What Sellers Are Doing While Buyers Wait

Understanding the other side matters.

Today’s Irvine sellers are:

Testing pricing carefully

Adjusting faster if response is weak

Increasing preparation and presentation

Sellers are not uniformly rigid. But they are selective.

A well-prepared home aligned with buyer expectations still moves decisively.

That’s why waiting does not automatically produce wide-scale discounts.

Cooling or Normalizing?

In many ways, Irvine today looks less like a cooling market and more like a normalized one.

Characteristics of normalization:

Reduced urgency

Rational pricing

Buyer comparison behavior

Clearer segmentation

Normalization benefits disciplined participants—both buyers and sellers.

It penalizes impulsive ones.

The Most Important Question

Instead of asking:

“When should I buy?”

Ask:

“What conditions would make me comfortable acting?”

That shift transforms waiting from passive delay into strategic positioning.

Final Thoughts

The Irvine market has not stopped. It has matured. Buyers are more thoughtful. Sellers are more measured. Decisions take longer—but they still happen.

Waiting can be wise. But only when paired with structure. Otherwise, it becomes drift. If you are in wait-and-see mode, make sure you are watching the right indicators—not the loudest ones.

Clarity always outperforms reaction.

Phone: (714) 902-3135

Email: myhome@zengrealestate.com